Title Page

-

Site conducted

-

Conducted on

-

Prepared by

Website Details

-

Website Address Reviewed

Item

-

****PLEASE TAKE SCREEN SHOT OF THE REGULATORY DISCLOSURES, REPRESENTATIVE EXAMPLES AND ANY OTHER KEY PAGES - EVEN WHERE IT IS CORRECT - TO RETAIN AS EVIDENCE - ATTACH TO THE EVIDENCE PAGE.*******

NOTE - IF THERE ARE ANY ERRORS THAT NEED TO BE DRAWN TO THE ATTENTION OF THE CLIENT, THEN ATTACH THEM TO THE RELEVANT SECTION AS NORMAL. -

************************************

-

****NOTE - IF THE FIRM IS NOT YET AUTHORISED THEN DO NOT USED THIS FORM - USE THE UNREGULATED WEBCHECK FORM*****

Regulatory Disclosure

-

Location of disclosure - Either on the footer or on the Finance Page, or page(s)where finance is advertised (e.g if finance advertised on home page then disclosure should be present) - NOTE: This disclosure should not be hidden to deep where an average consumer wouldnt be expected to have to go off looking for it.

-

Is there an appropriately located Regulatory Disclosure on the website?

-

Does the Regulatory Disclosure contain all of the required information?

-

If the disclosure does not contain all information, then inform the client specifically tailored to them what they need to put in rather than a generic description.

E.G All regulated financial promotions should include the firms registered name of XYZ Limited within the regulatory disclosure, rather than just XYZ -

• Displays the company’s name as it appears on the FS Register? E.g should be full legal name

• Lists any relevant trading names? (if trading name is significantly different from the legal name)

• Correct FCA disclosure? (Directly Authorised - xxx is authorised and regulated by the Financial Conduct Authority

• Correct FCA disclosure? (Appointed Representative - xxx is an Appointed Representative of xxx who are authorised and regulated by the Financial Conduct Authority etc…)

• Correct permission disclosure? (E.g.We act as a credit broker not a lender?) NOT REQUIRED FOR firms with permissions of HIRE AS OWNER - check FS register if unclear

• Basis on which broker introduces to lenders? (We can introduce you to a limited number of lenders who may be able to offer you finance facilities for your purchase? We will only introduce you to these lenders?)

• OR Where a broker refers to only one Lender / Provider, the name of the Lender / Provider should be stated?

Commission Disclosure

-

Commission disclosure may be in the T&Cs or within the IDD

-

If the disclosure needs updating, you can also send the client a copy of the template to assist them to get it right.

-

Is the fact that commission may be received disclosed (If applicable)?

-

Is the 'nature of the commission stated? i.e. commission is based on a percentage of the amount financed/fixed fee

-

Make sure not just old wording of "we may receive a commission"

Firm Information & Permissions

-

There should be a postal address for customers or other method of contact for customers if address not readily available. Best practice is for this to be in the footer area, but sometimes is on the Contact Us page. Should'nt have to go looking in T&Cs etc to find it.

-

Is a postal address/contact information clearly displayed on the website? (not hidden in documentation)

-

If present, does the postal address match the address on the FS Register?

-

Does other contact information displayed match the FS register? (email for complaints, phone number (general & complaints), etc)

-

Any evidence of new credit products being offered and/or sales channels being used that could indicate new FCA permissions required?

-

Any evidence of Insurance being sold? (insurer logos, or description includes mention of insurance being included or available, etc)

-

If mentions Insurance, does the firm have necessary FCA permission or exclusions?

-

Any evidence the firm does Personal Leasing?

-

If so are do they have the correct FCA permissions based on car source?

-

If photo of an actual car rather than just the manufacturer stock photo - this could indicate whether they own the stock or not. If own the stock then permission is Secondary or full credit broking

- if DONT OWN then should be full credit or broking for consumer hire and hire purchase.

Credit Promotions and Representative Examples (not relevant for Leasing)

-

Running account credit can include Paypal Credit and some types of Klarna offerings where you can use the credit across multiple sites as long as dont exceed credit limit.

-

Is the finance 'running account credit' - or is it offered?

-

Are the correct details for running account credit displayed?

-

If running account then does it show:

Assumed credit limit - e.g £1200

Interest rate and whether fixed or variable - e.g. 5.7% APR fixed

Representative APR - e.g. 11.5% Representative APR -

------------------------------------------------------------

-

OTHER TYPES OF FINANCE - REPRESENTATIVE EXAMPLE GUIDE

-

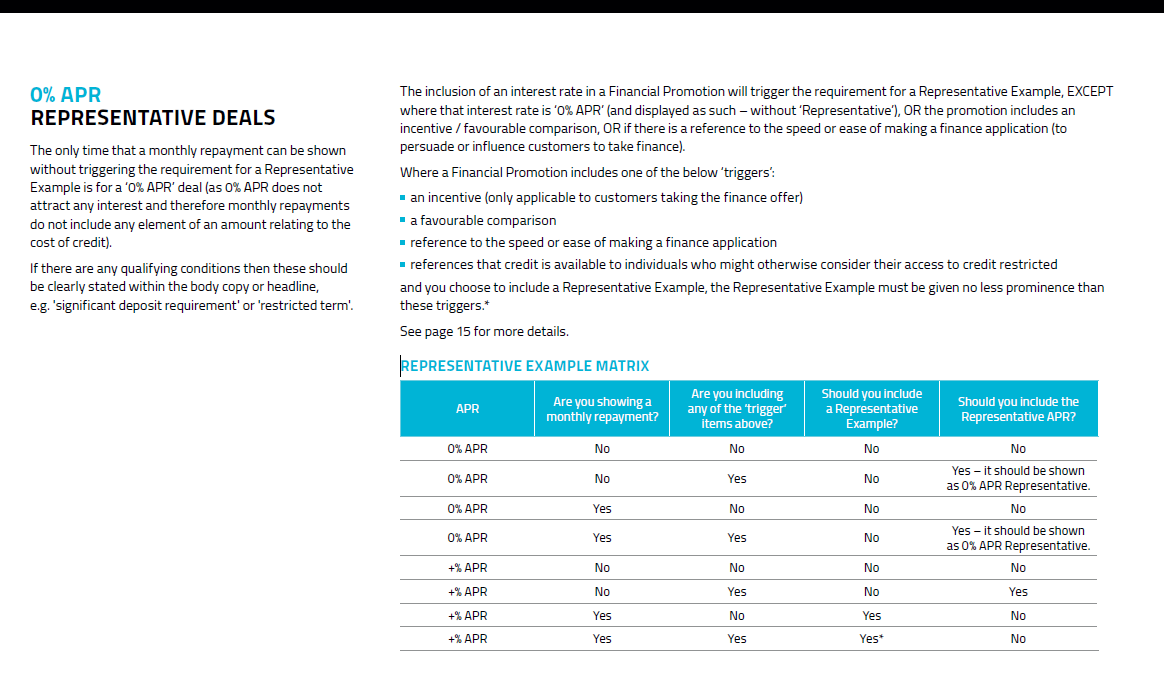

WHEN TO INCLUDE A REPRESENTATIVE EXAMPLE (& OR Representative APR)

The requirement to include a Representative Example is triggered when:

- A rate of interest is included in a Financial Promotion ) See Table 1 below

OR

- An amount relating to the cost of credit is included, such as the monthly payment (on a non-0% APR offer).

OR

-Certain phrases are used in the wording (See Table 2 below)

if unsure please ask!!! -

Table re interest rates and the requirement to include representative APR and/or representative example

-

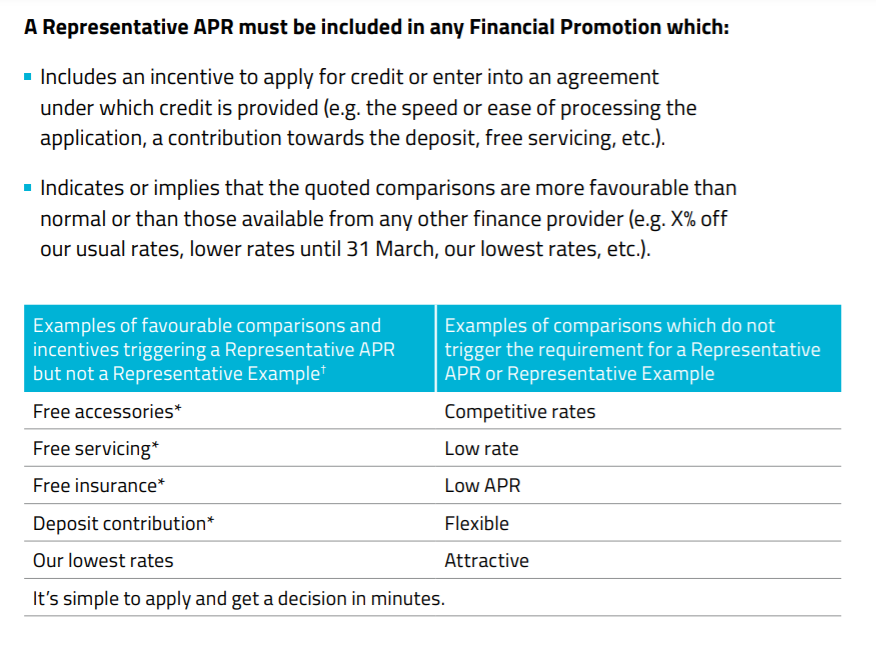

Some details of phrases which triggers the requirement to include a representative APR and either a representative example OR NOT

-

Is a full representative example required?

-

Is there only one representative example per page?

-

Only one example can be named 'Representative Example', visible at any one time - any others must be named either Finance example or Finance illustration. (They may not actually have a title - just as long as they are NOT under the heading of or titled "Representative Example".) - IF CAN Toggle product or credit rating then fine for rep example to change, but still should only be one at a time visible.

-

Is there a correct representative example on each page where finance is promoted?

-

Does the representative example provided contain the required details below: (Only finance purchase - not leasing)

- rate of interest, and whether it is fixed or variable or both, expressed as a fixed or variable percentage applied on an annual basis to the amount of credit drawn down;

- nature and amount of any other charge included in the total charge for credit - E.g Option to purchase fee (HP), or Document Fee

- total amount of credit or amount financed/borrowed

- representative APR; - The Representative APR must be expressed as ‘X.X% APR’ and be accompanied by the word ‘Representative’.

- cash price where it is a PCP or HP (Not applicable to Personal Loans) - should reference cash price rather than borrow xxx - OTR price is acceptable;

- amount of any advance payment - i.e. A Deposit (HP & PCP only - expect a value)

- duration of the agreement (number of months or years - e.g. 48 months)

- total amount payable

- amount and number of each repayment of credit? - 48 months x £265.44 (Cannot show weekly equivalents unless can pay on that basis) -

Are all elements of the representative example given equal prominence?

-

Is the representative example itself as equally prominent as the cost of credit or interest rate shown on the page

-

For example some information in bold larger text and some small regular

-

Are other factors that impact the potential total amount paid during the agreement and on termination prominently detailed?

-

Other Factors include 'Mileage limitations/charges'. - typically applicable to PCP

-

(“Please ensure that you periodically review any representative APR used to ensure that it meets the 51% test as required by CONC 3.5.5R”.)

-

Please tick the above checkbox.

Leasing (If Applicable)

-

If unsure as to whether site offering personal leasing - Prices should show inclusive of VAT if personal Leasing - business is excluding VAT.

-

Is Personal Leasing advertised?

-

Is the following information provided?<br>• The amount and number of monthly payments<br>• The initial payment<br>• The term/structure <br>• The mileage limit

-

Term/Structure example - initial rental and then the number of other payments (3+33)

-

REGARDING THE NEXT 3 QUESTIONS - Can be included on a separate page detailing specifics about leasing a vehicle - eg - How leasing works page

-

Is the excess mileage charge prominently stated?

-

Does it state that the customer will not own the vehicle?

-

Does it state that early termination charges (or that all payments have to be made if the agreement is terminated early) and/or damage charges may apply?

Terms and Images which cannot be used

-

Are there any phrases such as ‘finance experts’ and ‘finance specialists’

-

Can this phrase be substantiated?

-

Length of time firm been doing finance may be of assistance - or put note to firm to say tht firm should be able to evidence this if challenged.

-

Are there any phrases such as ‘FCA approved…’ and ‘FCA accredited…’?

-

Other than in the current PPL IDD

-

Is the FCA Logo displayed?

-

Any reference to Guaranteed Finance or pre-approved finance is made?

-

Any reference made to credit being ‘easy to obtain’ i.e. no credit checks and/or credit is available regardless of the customer’s circumstances?

-

Are there any references to a consumer credit licence?

Documentation and Statements

-

An IDD should be available for PPL Appointed Reps - for other firms an IDD is best practice. Send the firm a copy of the template to assist them.

-

Is an Initial Disclosure document available to download?

-

If the complaints information needs updating, you can also send the client a copy of the template to assist them to get it right. OR go a step further and tailor the complaint information for them and ask them to just replace the incorrect one with the new one.

-

Is there a full complaints procedures document/page relating to finance?

-

If there is a complaints procedure relating to finance on the website, is the process and information correct?

-

Is there a statement regarding the ability to request the complaint and FOS information?

-

Complaints process should be available for PPL Appointed Reps - for other firms is best practice

-

Does the complaints information contain the correct timeframes and customers rights etc. If lacking detail then send them a copy of our template.

-

Does any statement or documentation refer to the EU ODR (Online Dispute Resolution)? - As this no longer applies to UK businesses

-

If global website - need to be clear that EU ODR is not available to UK customers.

As above, send them a tailored complaints template for them to replace on their website to assist them to get it right.

Terminology and other factors

-

Product descriptions: Is a balanced view of the finance options provided? (i.e.? the potential risks are shown as prominently as the benefits?)

-

Favourable terms: Is a representative APR shown where there are any favourable terms?

-

Competitor comparisons: If comparisons are made to competitors can they be substantiated, are they up to date, is it a ‘like for like’ comparison or are differences between products clearly highlighted? (These issues make comparisons difficult and if used must be continually updated and checked for fairness)

-

Competitiveness: Where statements are made regarding the offer being more competitive than that of competitors can they be substantiated?

-

Finance offers with an end date: if a finance/credit offer has an end date, this must be fully displayed and the impact of missing the deadline clearly detailed?

-

Bad credit: Where references are made to the supply of credit to customers who may find it hard to get credit (e.g. have a ‘bad credit record’) is a representative APR shown that reflects the deal these customers are expected to get?

-

Customer Testimonials: Are any testimonials used? (If so the firm should be able to evidence these)

-

Credit Availability: Is reference made to credit being subject to criteria or similar wording? (E.g. Credit subject to Status or Terms and Conditions)

-

Premium rate telephone numbers: Is a premium rate line is used, the costs should be prominently displayed

-

Is the cost of the Premium phoneline prominently displayed?

Cookies Notice

-

If Cookies present, is there a Cookies consent notice?

-

Is there a Cookie Policy on Website?

-

Do any ‘Contact Us’ forms include link to Privacy Notice or other use of data description or warning where required?

-

Will the customer be clear on what the purpose of them filling in their details on the forms be for. - If not then the form should state the purpose or link to the privacy notice.

Privacy Notice

-

The content of Privacy notices can vary, information is not always in clear sections, so may require a thorough read through to find stuff

-

Is there a Privacy Notice/Policy available?

-

Does the Privacy Notice identify the Data Controller? (and where applicable, the data protection officer)?

-

Is the correct address shown on the Privacy Notice?

-

Is the purpose of the processing and the legal basis for processing mentioned?

-

Are the legitimate interests of the controller or third party provided, where applicable?

-

Are any recipient or categories of recipients of the personal data recorded?

-

Are the categories of personal data collected provided?

-

Are details of transfers to third parties and safeguards included?

-

Is the retention period or criteria used to determine the retention period included?

-

The next few questions are about the data subject rights and whether they are explicitly mentioned within the privacy notice

-

The source the personal data originates from and whether it came from publicly accessible sources

-

Is it mentioned whether the provision of personal data is part of a statutory or contractual requirement or obligation and possible consequences of failing to provide the personal data? (where applicable)

-

If the purpose of providing the data includes 'to provide the service (r similar wording) - this is deemed part of the contractual process - if you dont provide it then cannot provide the service (by default) might not be written out explicitly

-

Check the rights section, this may have a different title or use of words, e.g. may say "you can have incorrect data amended", instead of "you have the right to rectification"

-

Is the existence of each of data subject’s rights? <br>• The right to access data<br>• The right to rectification<br>• The right to withdraw consent at any time, where relevant <br>• The right to be forgotten<br>• The right to lodge a complaint with a supervisory authority?

-

Is the existence of automated decision making, including profiling and information about how decisions are made, the significance and the consequences, mentioned? (where applicable)

Social Media

-

Is finance advertised on Social Media?

-

Check if there are any other Social Medialpages listed under another name (typically linked to the manufacturer, or trading style.

-

Social Media used? (Detail sites)

-

*******NOTE: If there are old social media posts that are incorrect, we should reference the dates and inform the customer that these non-compliant posts should either be rectified or removed and why. *******

-

Do any promotions list any relevant trading names? (if required)

-

If trading name is signficantly different to the firms legal name then should be included

-

Do any promotions contain the correct FCA disclosure?

-

Authorised and regulated, or Appointed Rep of....

-

Do any promotions contain a postal address?

-

Where cost of credit or an interest rate is shown on the post - then address should be included on the post

-

Do any promotions detail the correct permission disclosure?

-

Permission disclosure includes 'Credit Broker not a Lender', etc

-

Do any promotions display the company’s name as it appears on the FS Register?

-

Where finance is advertised then the post should be stand alone compliant and the full FS register name should be shown

-

NOTE - Full representative example question below is not required for leasing - see leasing section for details of information that should be shown

-

Is a full representative example required?

-

Does the promotion include a representative example?

-

Does Representative Example contain all required information?

-

Does the representative example provided contain the required details below: (Only finance purchase - not leasing)

- rate of interest, and whether it is fixed or variable or both, expressed as a fixed or variable percentage applied on an annual basis to the amount of credit drawn down;

- nature and amount of any other charge included in the total charge for credit - E.g Option to purchase fee (HP), or Document Fee

- total amount of credit or amount financed/borrowed

- representative APR; - The Representative APR must be expressed as ‘X.X% APR’ and be accompanied by the word ‘Representative’.

- cash price where it is a PCP or HP (Not applicable to Personal Loans) - should reference cash price rather than borrow xxx - OTR price is acceptable;

- amount of any advance payment - i.e. A Deposit (HP & PCP only - expect a value)

- duration of the agreement (number of months or years - e.g. 48 months)

- total amount payable

- amount and number of each repayment of credit? - 48 months x £265.44 (Cannot show weekly equivalents unless can pay on that basis) -

Is the representative example itself as equally prominent as the cost of credit or interest rate shown on the page

-

Are all elements of the representative example given equal prominence?

-

For example some information in bold larger text and some small regular

*******Evidence Page******

-

Regulatory Disclosure

-

Representative example

-

Monthly Prices

-

Other relevant pages/text