Information

-

Document No.

-

Audit Title

-

Client / Site

-

Conducted on

-

Prepared by

-

Location

-

Personnel

-

This is a validation audit to check on the corrective measures implemented at the site after service providers were informed of the findings in the March 2016 internal audit using WM standards, and after claims of correction have been made. This audit focuses on the LABOR, COMPENSATION, HIRING AND EMPLOYMENT PRACTICES dimensions identified as HIGH RISK by the Walmart consultant. Although the findings in the audit were specific to certain service providers, the assumption is that all other service providers may also have such issues on their practices. Hence ALL SERVICES PROVIDERS will be subjected to the validation.

-

INSTRUCTION TO AUDITOR:

1. Discuss the particular finding or issue with the auditee of the service provider. Auditor should be able to explain the issue in detail if needed, and make sure the auditee understands the issue.

2. Ask the auditee what corrective action have they done to address the particular finding.

3. Request for proof of the corrective action. Take photos and write notes/observations pertaining to the corrective action.

4. If no corrective action, auditor must indicate accordingly and write observations and suggestions as needed.

5. Do the above for each issue.

6. For sampling purposes, auditor must randomly select at least 5 names from a list of workers who are working at the moment. This list will be sent through email.

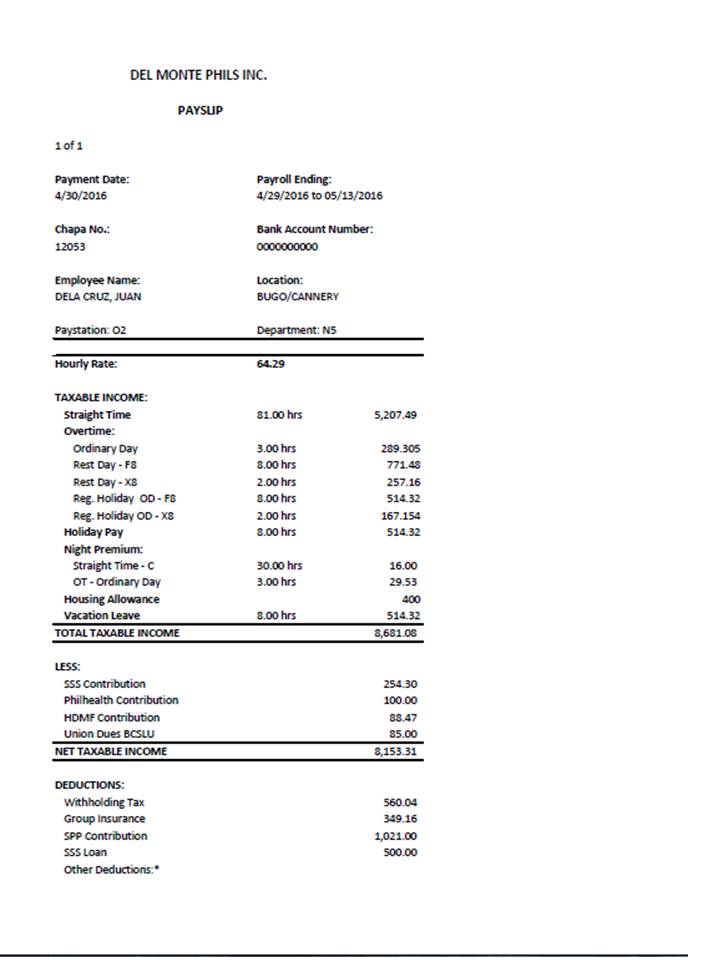

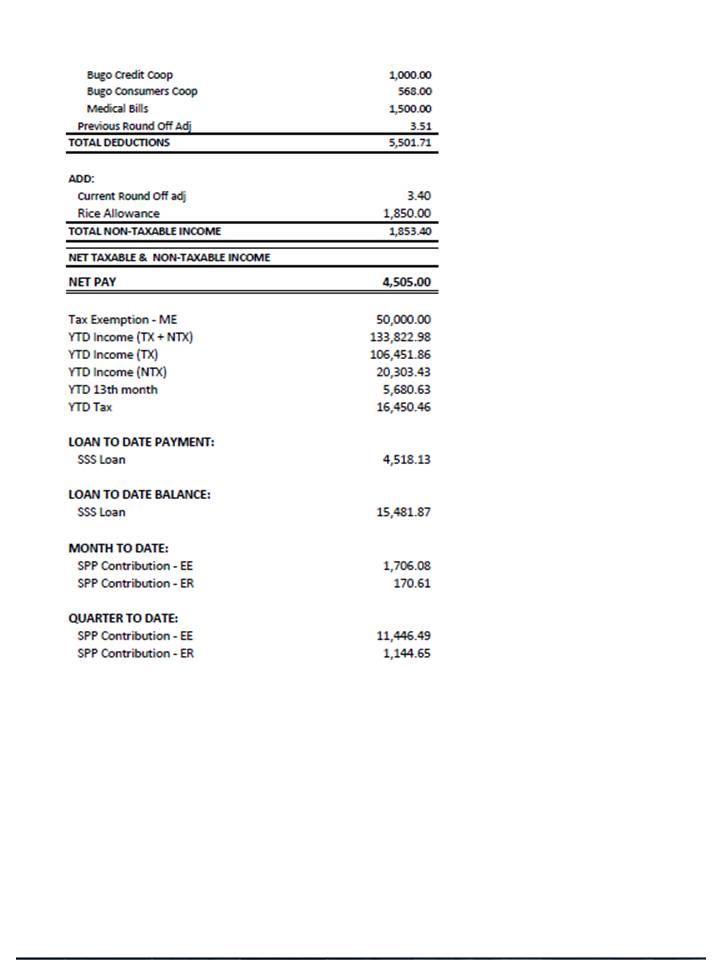

STANDARD: Provide accurately calculated proof of payment that clearly shows regular and overtime hours worked, regular and overtime rates and wages, leaves, bonuses, and deductions.

-

VIOLATION: Payslips for both regulars and contractuals contain "merged" fields making it difficult to clearly identify straight time, overtime, and holiday work.

-

CORRECTIVE: Implementation of model payslip (See format).

-

-

-

Has the service provider implemented a model payslip based exactly on the format shown or containing all the elements?<br>Note: Some elements on the model payslip such as SPP, Coop loans, etc. may not be applicable to service providers.

-

If answer is NO, ask for sample payslip of the service provider and inspect for presence of key elements found in the model payslip. Does the payslip contain the key elements?

-

Does the payslip contain the name and other key information such as employee number?

-

Does the payslip contain the correct pay period?

-

Does the payslip contain the salary rate of the employee?

-

The current minimum wage is Php 318.00 per day or 39.75 per hour. Is the rate of the worker within the minimum wage?

-

Does the payslip contain detailed breakdown of the hours worked and the corresponding computation based on the hourly rate of the worker?

-

Auditor must do sample computation of worked hours using the worker's rate. Are the computations correct and in accordance with statutory rates and premiums?

-

Are deductions being made ONLY for authorized or legal deductions?

-

Are deductions properly broken down?

-

Are there NO unauthorized or dubious deductions made?

STANDARD: Ensure that workers understand how their wages are calculated.

-

VIOLATION: Based on interview, some workers do not fully understand how their wages are calculated.

-

CORRECTIVE: Inclusion of wage computation and understanding the payslip module in employee meetings and induction programs. Payslip format revision to enhance proper understanding.

-

Auditor to ask for proof of inclusion of understanding wage computation in worker meetings and induction trainings. Auditor also to ask for attendance sheet of meetings related to understanding wages. Was the service provider able to produce the documentary proof?

-

In lieu of info drive stated above, is the payslip of the service provider easy to understand and contains clear and accurate information for the worker?

-

WORKER INTERVIEW: Auditor to randomly select 5 workers of the service provider and ask this question:

-

Do you understand how your quincenal pay is computed?

-

Do you understand how your quincenal pay is computed?

-

Do you understand how your quincenal pay is computed?

-

Do you understand how your quincenal pay is computed?

-

Do you understand how your quincenal pay is computed?

STANDARD: Suppliers shall pay all workers employed, on probation, undergoing training, or participating in an apprenticeship program.

-

VIOLATION: Workers on probationary or on OJT are not compensated in accordance with labor laws.

-

CORRECTIVE: Stoppage of OJT program; or compensation of all OJT/proby workers.

-

If the service provider claims stoppage of OJT program, has it been stopped? Ask for proof of stoppage such as memo or directive.

-

If the claim is proper compensation of OJT, auditor should ask for current list of names of OJT/proby employees. Auditor should also ask for sample payslip or payroll records of the OJT/proby worker. Are the employees properly compensated in accordance with law (at least 75% of minimum wage)?

STANDARD: Personal protective equipment must be provide free of charge.

-

VIOLATION: For service providers PPE are not provided free of charge at all times; sporadic issues on workers paying for their own.

-

CORRECTIVE: Stoppage of all forms of PPE deduction and disallowing of workers from buying their own PPE.

-

NOTE: Operations team has developed guidelines on PPE issuance which includes prohibition of charging PPE to workers. Operations team and Safety Dept will be responsible for implementation of this.

-

Auditor must examine sample payslips and check for deductions on PPE, uniform, annual PE. Are there no deductions made on the above items?

-

WORKER INTERVIEW: Audit of this aspect will only focus on worker interviews. From the same sampled employees, auditor must first explain to the worker what is a PPE and will ask this question. Please enter some explanatory text if needed.

-

Have you ever paid for your own PPE?

-

Have you ever paid for your own PPE?

-

Have you ever paid for your own PPE?

-

Have you ever paid for your own PPE?

-

Have you ever paid for your own PPE?

STANDARD: Suppliers must provide employment contracts to all workers that comply with the applicable laws.

-

VIOLATION: Some older employees do not have copies of employment contract in their 201 files. For service providers, some employment contracts contain non-compliant provisions.

-

CORRECTIVE: Reissuance of contract to all hourly-paid regular employees containing present terms and conditions. For major service providers: contracts are due for renewal on June 1. New contracts should now contain all key components and should not have any non-compliant provisions.

-

From the employees sampled, the auditor checks the 201 file of each employee.

-

Do all the employees sampled have employment/deployment contracts filed in the 201 folder?

-

Does the contract contain at the minimum the following items? Select NO if at least 1 item is not found in the contract.<br>The contract must be provided in a language understood by the worker.<br>Terms and conditions of employment.<br>Wage at hiring.<br>Date of joining.<br>Name and date of birth of the worker.<br>Benefits associated with the wages.<br>Signature of the worker.

-

WORKER INTERVIEW: Auditor needs to check if the worker has a copy of his employment contract.

-

Did you receive the original of your employment contract?

-

Did you receive the original of your employment contract?

-

Did you receive the original of your employment contract?

-

Did you receive the original of your employment contract?

-

Did you receive the original of your employment contract?

STANDARD: Time In and Time Out are recorded accurately and must be acknowledged by the workers themselves.

-

VIOLATION: Working hours documentation is not 100% accurate. Acknowledgment system is not fully compliant.

-

CORRECTIVE: For regulars, the DTR must accurately reflect the department time in and out as captured by the RFID readers. For areas and service providers that still use manual timekeeping via DTR, all entries must be accurate, signed by worker.

-

Auditor needs to check time sources and actual payslips of sampled employees. For service providers doing manual, auditor must check on DTRs and examine for accuracy and completeness of information. For those already using RFID or automated capture (e.g. FAST), auditor must request for RFID records and check against actual hours reflected in the payslips.

-

Are the DTR entries complete and accurate?

-

Are the signatures of individual workers completely captured in the DTR?

-

Do the worked hours reflected in the payslip tally with the hours recorded in the DTR or RFID?

-

Please note that there may be differences between RFID time in and DTR entries because of the 30-minute time in allowance as the workers do not arrive at the same time.

STANDARD: Suppliers shall not ask workers to make any payments for an assurance to work. Suppliers shall not charge workers recruitment fees or take deductions from their wages for being hired.

-

VIOLATION: For co-op service providers, the "member share capital buildup" may be construed as an assurance to work fee. No co-op worker can work if he does not start contributing for capital buildup. This form of deduction may also be seen as illegal or unauthorized.

-

CORRECTIVE: The co-op based service providers have various corrective measures for the issue. Auditor needs to check their respective measures:

Asiapro - Member sign-off sheet on payment options. Member signifies if he prefers to have the share capital contribution deducted from his pay or to pay in cash.

B-Mirk - stoppage of deduction.

Allied - stoppage of deduction and issuance of certificate of share capital. -

Do the coop based service providers have any document to prove that the corrective measures are done?

-

Auditor needs to check sample payslips. Are there still any deduction for share capital done?

STANDARD: Suppliers shall pay all workers the applicable overtime premium rate for all overtime hours worked.

-

VIOLATION: Based on interview, workers claim that their worked hours beyond 10 hrs were not considered/recorded, therefore not paid.

-

CORRECTIVE: All overtime is properly recorded, reflected and paid.

-

Auditor needs to check through sampling if the issue still exists. This kind of issue cannot be easily checked or validated since majority of service providers still rely on manual DTR-based timekeeping. This can however be checked by looking at historical RFID records of the hours that the subject worker is inside the compound and comparing these with DTR entries and payslip records. Auditor therefore needs to do the following:

-

1. Interview sampled workers and ask the question: Have you ever experienced working beyond 10 hours but being timed only for 10 hours? Please ask for details.

2. If a worker answers YES, auditor must ask the worker WHEN that incident happened (up to a month's accuracy).

3. Auditor then requests ART BENEDICTOS to provide RFID records for that particular person.

4. Upon receipt of the file, the auditor examines the time in and out for the period given and compare the hours worked with what is reflected in the DTR. There will be some normal variance because the RFID info is GATE IN and GATE OUT which are not yet the department TIME IN and TIME OUT.

5. Auditor should look for an unusual variance or an abnormal difference between RFID hours worked and DTR hours worked. This might be the particular incident that the worker is referring to.

6. For the purpose of this audit, this incident will be our tentative "validation" of the claim of the worker. This will not be conclusive but may now be flagged for further investigation. -

From the sampled workers, is there NO case of unusual or abnormal variance between RFID and DTR hours worked?

OTHER COMPENSATION ITEMS

-

Auditor must also check on other high-risk compensation matters and basic statutory benefits. Need to examine samples to determine compliance to the following. The auditor has the option to add random samples at this point.

1. Accuracy and consistency of information on DTR vs PAYSLIP. What's in the DTR should also be what's in the payslip.

2. Complete and up-to-date REMITTANCES TO SSS, PAG-IBIG, PHIC.

3. Compliance to HOLIDAY PAY and related premiums. See list of Holidays from Jan 2016 to present.

4. 13TH month Pay

5. Service incentive leave payment

6. Paternity / Maternity / Magna Carta

7. Overtime computation – Hours vs Rates

8. Validity of Deductions, including accuracy.

9. Night premium payments. -

Are the DTR and PAYSLIP consistent?

-

Are the remittances to SSS, Pag-Ibig and Philhealth up to date and complete?

-

Has the service provider completely paid unworked legal holiday (as long as the worker complies with requirements)?

-

Has the service completely paid the 13th month pay (1st half) to all workers?

-

Are members able to fully avail of their 5-day service incentive leave?

-

Are members able to fully avail special leave benefits such as the following: maternity, paternity, solo-parent, magna carta for women?

-

Are overtime and premium computations in accordance with labor laws and wage orders?

-

Are deductions reflected in payslips valid, and for personal deductions authorized by the employee?

-

Are night shift differential payments given and correctly computed?